Happy Sunday! Welcome to our 62 new readers!

This week is about all things Coral. Read on for more…

In today’s edition:

🌊 The Coral Financing Gap

🌳 $50mn for Rewilding startups

💼 A whole new suite of NatureTech jobs

🐘 Long Read (5-Min Read)

Billions of innovative financing through two new Coral reef initiatives🪸 🐠

The Coral Crisis: Coral reefs support 25% of marine life, provide $1.8Bn dollars in flood protection and support the livelihoods of 1 billion people. However, reefs are under severe threat from climate change, ocean warming and overexploitation from human activities.

The Ocean Finance Gap: Estimates suggest that the global investment required for coral reef protection is approximately seven times greater than current funding levels. Marine Protected Areas (MPAs), ocean zones where human activity is limited, are particularly underfunded. 70% of 20,000 global MPAs can't meet basic management standards.

🐠 1) Africa’s Debt for Coral Swap

What is it: At least five African countries are working on a joint $2 billion debt-for-nature swap to finance coral protection and restore 2 million hectares of Indian Ocean ecosystems by 2030

How does it work:

1. A country's existing debt is purchased at a discount.

2. This debt is replaced with new, lower-interest debt.

3. The savings from lower interest payments are directed to conservation efforts.

4. An organisation is set up to manage the conservation funds.

5. Local communities and conservation groups implement protection measures.

Why it matters: First multi-country debt-for-nature swap. Sets a new precedent for regional cooperation in conservation financing. Could benefit 70 million people in coastal communities.

🌊 2) A world first - Coral Impact Loan

What is it: BNP have launched a Blue Impact Loan which enables reef-positive businesses in MPA’s (ecotourism, sustainable aquaculture, blue carbon) to access cheap finance if they achieve environmental outcomes. It aims to regenerate 1.8 million hectares of coral reef ecosystems globally.

How does it work:

1. Philanthropic partners provide initial risk-absorbing capital. This acts as a "first-loss" layer, absorbing initial financial losses if they occur. This Lowers risk for private investors and encourages more investment.

2. Private investors contribute to impact-focused loans.

3. Funds are allocated to local reef-positive businesses in MPAs. Philanthropic capital allows the loan to offer more favourable terms to reef-friendly businesses, increasing their chances of success.

4. Businesses generate sustainable revenues to repay loans.

5. Loan repayments are significantly lowered if specific social and environmental outcomes are achieved.

Why it matters: First coral-focussed loan facility. Helps philanthropic capital go further by encouraging private sector financing = more funding for Ocean conservation.

🚀 What it means for NatureTech Startups

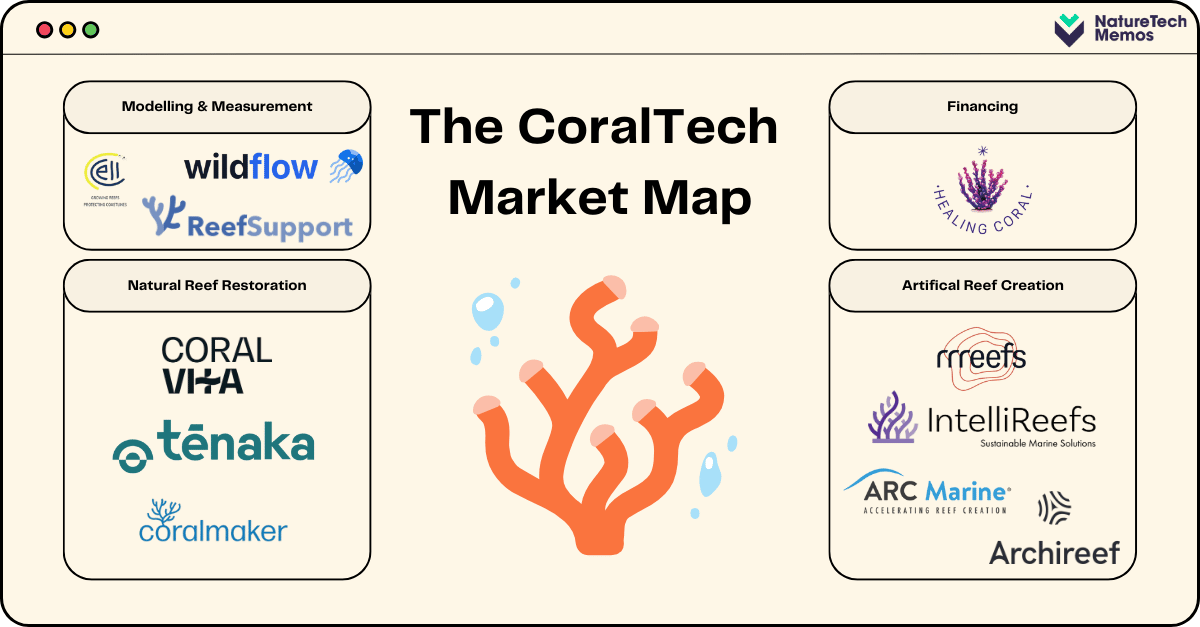

Critical to both these initiatives is ensuring that financing is directed to projects with coral-positive outcomes… There are multiple start-ups we like in this space:

Wildflow - Creates digital twins of coral reef to enable better monitoring of restoration projects

CoralVita - Operates farms to rapidly grow corals more resistant to environmental challenges

Rrreefs - 3D print structures that mimic reefs to provide habitats for coral larvae and fish

Reply to this email if you would be interested in us taking a deep dive into the entire start-up landscape or let us know who else you know operating in this space.

💬 Snippets for your lift conversations

💼 Big business:

The World Sustainable Hospitality Alliance, comprising more than 100 businesses, has launched a new campaign to help firms deliver nature-based solutions in their communities and supply chains.

The Crown Estate has published a Nature Recovery ambition, pledging to increase biodiversity across its land and sea holdings by 2030 while supporting climate adaptation and resilience.

Regeneratively-farmed milk to launch in UK supermarket, Tesco stores nationwide

🏦 Finance:

Bloomberg has launched a tool for investors to assess the nature impacts and dependencies of around 45,000 companies.

El Salvador has sealed a new-style debt buyback deal where savings generated will be used to fund conservation of the country's main river and its watershed.

King Charles III & other British landowners are working with ecologists to restore nature as a basis to create a new kind of financial credit: ‘nature shares’.

'Habitat banks': Environment Bank and Barclays team up to offer Biodiversity Net Gain credits

Funds focused on companies with solutions to nature loss have been the only biodiversity-related investors in the sector to attract net new money this year according to research.

The Biodiversity Investments Researcher & Accelerator (BIRA) Coalition is creating a buyers club to raise millions of dollars through nature credits generated in Sub-Saharan Africa

🌴 Market & Projects

The American Forest Foundation (AFF) is set to host its first carbon auction in February 2025, offering a streamlined & transparent process for companies to purchase nature based carbon credits.

UK-based investment manager Ninety One has launched the Sovereign Biodiversity Index to help investors assess national-level nature risks.

📖 Research:

Easter Island, the tiny remote speck of land in the middle of the Pacific Ocean, is stuck in an oceanic vortex of plastic.

Two startups pilot an experiment (The BOxHy Project) looking to reoxygenate the Baltic Sea by producing hydrogen at sea in an effort to prevent marine biodiversity loss through asphyxiation.

Durham University researchers create buzz with new robotic system to help better understand the world's most prolific pollinators

📝 Policy:

Just 29 out of almost 200 countries have submitted their National Biodiversity Strategies and Action Plans (NBSAPs), ahead of the COP16 deadline, organisers have revealed.

The government of the Brazilian state of Para in the Amazon will consult Indigenous communities on how they will benefit from the future sale of carbon offset credits.

Indonesia, Malaysia and the European Union will formulate a practical guide to EU deforestation rules (EUDR) for smallholders by November, an intergovernmental group said.

Developed countries are paying less than 50% of their ‘fair share’ towards biodiversity finance that was agreed in the Kunming-Montreal Global Biodiversity Framework (GBF) at COP15.

🐸 Fun:

🎣 Deals

2 Start-ups in our network are raising. Get in touch for more info!

UK based, Nattergal raised $52.2m in Seed Funding, to scale its rewilding and Nature restoration investors included Aviva

German startup, OroraTech raises $27.1m in Series B, to scale its wildfire early warning system. Investors incl. Korys,The EU’s Circular Bioeconomy Fund (ECBF)and Bayern Kapital.

Australian startup, Viridian Renewable Technology raised, $2.5 million in seed to turn food waste into animal feed from The Victorian government

California start-up, Terviva, raised an undisclosed fee to make food, feed and fuel from pongamia trees, from Chevron Renewable Energy Group

💭 Little Bytes

📊Read: WWF and TNFD unite to launch nature data public facility

📺Watch: Can Precision Tech Help Conserve the Rainforest?

💬 Listen: Ancient DNA debunks Rapa Nui ‘ecological suicide’ theory

📆 Events

21 Oct to 1 Nov - COP16 - For those attending check out Joshua Berger’s awesome summary of events

16 October - greenwashing and greenhushing: navigating the corporate goldilocks zone - London

24 October - Bloom - Colombia

29 October: Wildya+ Masterclass: How to find product market fit with Anna Alex (Nala)

💼 Jobs

Special thanks to Theresa Lieb for this awesome list…

Also check out our friends from Superorganism’s job board

Check out Wildya.earths Nature job course

🐼 Corporate

Lego, Senior Manager, Global Sustainability Water and Nature (Billund, Denmark) https://lnkd.in/eNzNBStK

Danone, Sustainability Manager, Nature (Hoofddorp, Netherlands) https://lnkd.in/ex4DhJ-F

Danone, CDI — Nature Controller (Paris, France) https://lnkd.in/ekD_XqCK

ClimeCo, Project Manager, Nature Based Solutions (remote, US)https://lnkd.in/ei5mwwH9

IUCN, Programme Officer, Business and Nature (Cambridge, UK)https://lnkd.in/eauQUgTY

WWF, Knowledge Manager, Freshwater Practice (hybrid, Europe) https://lnkd.in/embs7iRY

🐝Finance

BTG Pactual Timberland Investment Group, Portfolio Manager (New York, US) https://lnkd.in/ejmizFMP

Conservation International, Americas & Amazonia Bioeconomy Investment Lead - CI Ventures (Brazil, Colombia or Peru) https://lnkd.in/eAYe3znB

🦊 Nature-based solution projects & nature tech startups

Treeconomy, Product Lead (hybrid, UK) https://lnkd.in/ekn39H4k

Conservation X Labs, Senior Director of Development (Washington, DC, US) https://lnkd.in/eC5Wc_Mc

Carbon Farm, Product Manager (Paris, France) https://lnkd.in/er-nKPJ4

📩 Feel free to send us deals, announcements, or anything else at [email protected] . Have a great week ahead!